What’s included

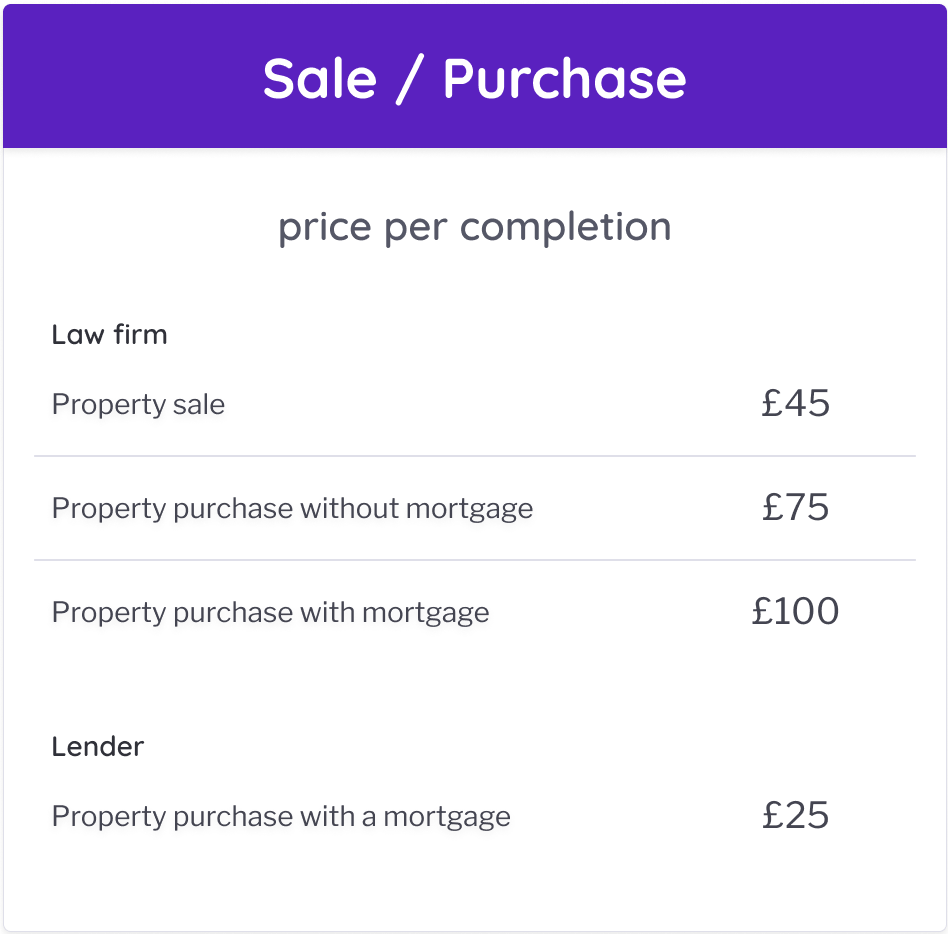

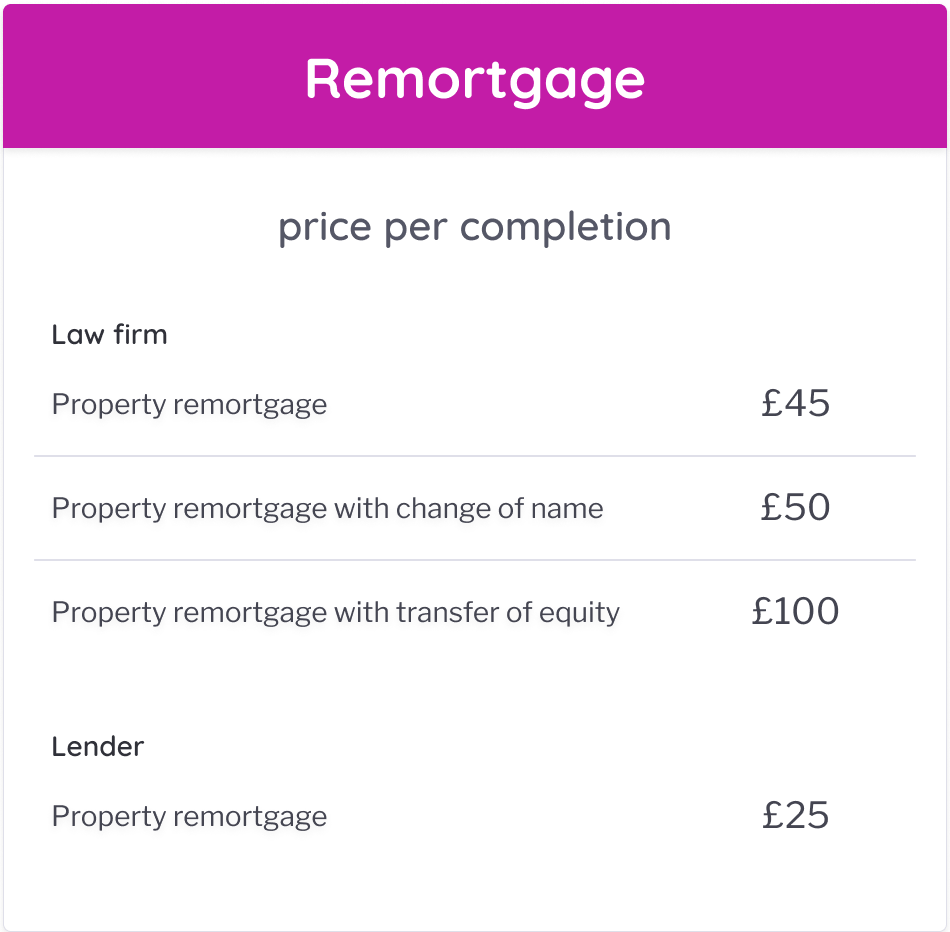

PEXA pricing is straightforward, outcome-based, and designed to support both law firms and lenders. All prices are per completed transaction and exclusive of VAT. Our prices include:

Access to secure platform enabling digital property completion

Direct integration with HM Land Registry for property title lodgement

Secure movement of funds via PEXA Pay, utilising central bank money through the Bank of England’s RTGS system

Automated title validation and checks, with real-time status visibility for conveyancers and lenders

Dedicated UK-based support and onboarding

No setup fees. No ongoing subscription. You only pay when a transaction successfully completes.

(Note all fees exclude VAT)

About PEXA’s Standard Pricing

-

The fees shown here are PEXA’s standard platform fees for our customers. Separate or different fees may be chargeable to the lender and the law firm for any transactions completed via the PEXA Platform in the future.

-

These fees are published to help our customers understand how the PEXA Platform works in terms of charges that they will pay, but they may not be the same as the fees you see in your final bill or statement of charges from your lender or law firm.

-

PEXA’s standard prices may change from time to time. We will update this page when that happens. PEXA will give 3 months’ notice of any changes in advance to your lender or law firm.

Law Firm and Lender Responsibilities

-

Your law firm or lender decides how to handle PEXA’s fees. They may, for example:

-

absorb the cost themselves,

-

pass it on to you as a disbursement without any change, or

-

add it to their own fees.

-

-

Every law firm and lender is responsible for explaining their own charges to you in line with their regulatory duties.

-

Because of this, the final fees you pay could be different from PEXA’s standard pricing.

-

If you are a customer of a law firm or lender, please ask your law firm or lender for a full breakdown of their fees, including how they treat PEXA’s charges.

PEXA’s Regulatory Position

-

PEXA is regulated by the Financial Conduct Authority (FCA) and follows Principle 12 of the Consumer Duty – delivering good outcomes for retail customers.

-

However, PEXA does not regulate, monitor, or control law firm or lender pricing. Each firm makes its own commercial decisions.